THE WISE WAY TO DEFER CAPITAL GAINS TAXES

Terminology

Transparent Fees for CXS's Services

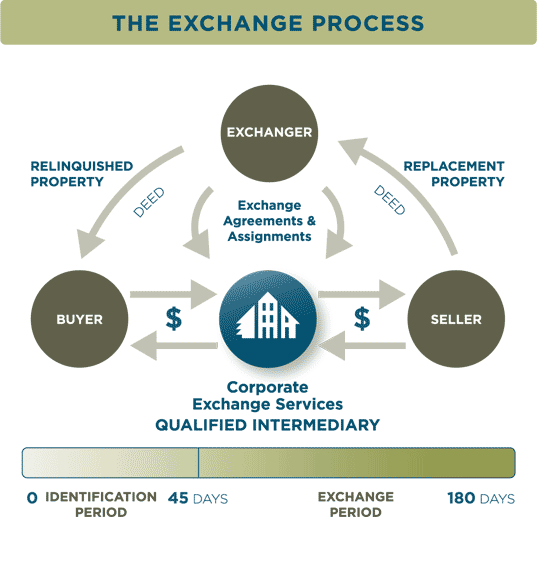

Prior to closing the Relinquished Property, the Taxpayer signs an Exchange Agreement with Corporate Exchange Services (“CXS”) and assigns the seller’s interest in the purchase agreement for the Relinquished Property to CXS. CXS directs the closer to disburse the proceeds of the sale to CXS, and directs the Taxpayer to directly deed the Relinquished Property to the Buyer. CXS invests the proceeds of sale until the purchase of the Replacement Property.

The Taxpayer must identify potential Replacement Properties within 45 days of the closing of the Relinquished Property. Taxpayer has 180 days from the same date to close on the purchase of the Replacement Properties. Prior to closing the purchase of the Replacement Property, the Taxpayer assigns the purchaser’s interest in the purchase agreement to CXS. CXS uses the invested sale proceeds to purchase the Replacement Property and directs the Seller to directly deed to the Taxpayer.

“Like Kind” Property

Exchange Requirements

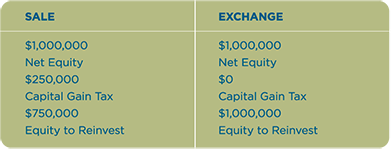

Sale Vs Exchange

Assume an investor sells a fully depreciated property with no debt for $1,000,000. The capital gain is $1,000,000 ($600,000 from the depreciation recapture and $400,000 from the appreciation). The current federal tax rate is 25% on depreciation recapture and 15% on appreciation. Assume state rate of 4%.

The deferral of the payment of capital gains taxes clearly allows the investor to purchase replacement property of substantial greater value than the investor who sells and pays capital gains taxes!

Reverse Exchanges

Corporate Exchange Services